“The construction industry and the over 2 million of jobs it supports cannot expect to emerge unscathed from the coming recession but it is important fatalism does not kick-in. The industry is not powerless in the face of events and our leaders can pursue strategies that have a good chance of minimising the damage.”

The storm clouds are gathering around the British economy with soaring inflation, rising interest rates and collapsing confidence all combining to make the long-feared cost of living crisis a reality for millions of households.

The construction industry and the over 2 million of jobs it supports cannot expect to emerge unscathed from the coming recession but it is important fatalism does not kick-in.

The industry is not powerless in the face of events and our leaders can pursue strategies that have a good chance of minimising the damage. This does however need clients, tier 1 contractors and the supply chain to recognise that they share an interest in keeping projects and programmes viable and to find intelligent and flexible ways to share the risks created by the current turbulence.

If that can be achieved we will be able to shield more workers from short term pain. It can also help avoid the permanent loss of thousands of people from the construction workforce that has been the consequence of previous recessions. This is vital. The industry simply can’t afford a further loss of capacity and capability on this scale. Over the next decade the sector and its clients face a series of huge and largely unpostponable tasks including delivering its contribution to decarbonising the economy, tackling a housing crisis and providing the infrastructure to drive flagging productivity. In these circumstances we simply must avoiding adding to construction’s already endemic recruitment, retention and skills development problems.

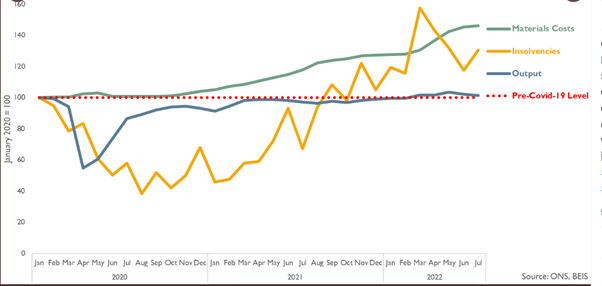

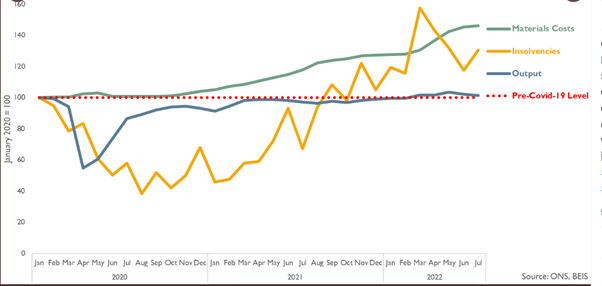

Construction is contracting; but from a high base

In 2021 and into early 2022, construction recovered well from the COVID 19 and overall output surpassed its pre-pandemic peak this Spring. This has led consultancy giant Arcadis to conclude in its UK Autumn 2022 Market View that, “with the slowdown starting from a highpoint, competitive pressure will take the edge off future price rises and this will be a shallow but prolonged dip rather than a blow out”.

So, it is important that we don’t panic and recognise we are entering a downturn on the back of the sector’s strong post COVID performance. In fact in some sub-sectors COVID is likely to have itself been a driver of growth with the race for space and the trend towards home working, fuelling demand for both new housebuilding and private repair & maintenance.

This growth has been achieved despite a backdrop of accelerating inflation. Taking one example year on year inflation of construction materials peaked in June this year at 26.4% (falling back to 17.8% in August). Price rises for some materials have been even more pronounced with aggregates up 62% according to the Office of National Statistics.

Inflation clearly isn’t going away and will now start to combine with some of the other drags on the sector – creating a dangerous moment. In a recent twitter thread, Noble Francis, Economics Director at the Construction Products Association explored the potential impact of inflation over the coming year. He suggests that “the key question will be, even if UK construction materials price inflation slows…, if it remains double-digit as construction demand falls … what will be the impact on the industry when UK construction has already lost 3,841 firms in the 12 months … its highest level since the financial crisis, (even) when demand has been strong”.

Construction output, insolvencies and materials costs 2020-22

Causes driving concern

Noble’s assumption of continued cost inflation seems well founded. The war in Ukraine and the recent decision by OPEC to reduce oil supplies suggest high energy costs are baked in for the foreseeable future. Wage inflation is also likely to be an issue with 71% of respondents to a recent Association for Consultancy and Engineering survey citing this as a major business concern.

On the demand side, house building, the single largest sub-sector of construction, was already slowing before the previous Chancellor’s mini-budget. This has led markets to price in higher-than-expected rises in interest rates, which in turn is driving up the cost of mortgages, slowing demand and causing a steep fall in the share price of the big housebuilders. Higher mortgage costs will also add to the squeeze in household incomes, cutting discretionary spending on private repair, maintenance and upgrade activity. Finally, the Building Safety Act received Royal Assent in April, and a new, post Grenfell safety regime for higher risk buildings will come into force over the next 18 months. This seems likely to push up costs for building residential towers, contributing further to the slowdown.

Inflation and uncertainty also seem likely to lead to more commercial property schemes, paused, rescheduled or cancelled altogether – even before the impact of the trend towards homeworking is taken into account. As a result investors are clearly re-thinking their strategies or even pulling out of the UK market completely.

On a more positive note, infrastructure (the second biggest sub-sector of UK construction) will hopefully benefit from ongoing mega projects such as Tideway and HS2 and the stability that comes from being financed via government or regulated utilities. Even here however there are reasons to be fearful. Budgets agreed at the last spending review are now worth less and the incoming Chancellor is looking to make big cuts to public spending. Local Authorities in particular are facing a heavy squeeze and even regulated businesses such as water companies may be tempted to push back projects into the next 5 year investment programme.

Avoiding a hard landing: What can be done?

One way of looking at current events is that the industry is returning to pre 2008 economic norms, leaving behind a decade of ultra-low interest rates in which policy makers have often worried more about deflation than rising prices. This must not lead to a return to some of the short-sighted, devil take the hindmost attitudes that too often characterised that era. When there is a shrinking amount of money in the system, clients or tier 1 contractors who try to push costs and risks down the supply chain do nothing to improve the long term viability of work programmes and will ultimately create a situation in which there is less work for everyone and more importantly worse outcomes for the public.

On this theme, Arcadis’ market update urges contractors to not panic and trigger “a race to the bottom in bidding and standards”. They also call on clients to “consider whether greater integration and collaboration can deliver more viable projects and deliver a better outcome”. Fundamentally clients, contractors and contractors need to recognise that over the medium to long term, demand remains high and they share an interest in maintaining the viability of projects and programmes. They should be willing to have sensible conversations about how to share the risk (and pain) that the current situation is generating and ensure that this is reflected in procurement and delivery strategies. Self-interested short termism on the other hand will prolong the pain of the downturn and store up yet more skills shortfalls in the decade ahead.

Share This Story, Choose Your Platform!

Related News

“The construction industry and the over 2 million of jobs it supports cannot expect to emerge unscathed from the coming recession but it is important fatalism does not kick-in. The industry is not powerless in the face of events and our leaders can pursue strategies that have a good chance of minimising the damage.”

The storm clouds are gathering around the British economy with soaring inflation, rising interest rates and collapsing confidence all combining to make the long-feared cost of living crisis a reality for millions of households.

The construction industry and the over 2 million of jobs it supports cannot expect to emerge unscathed from the coming recession but it is important fatalism does not kick-in.

The industry is not powerless in the face of events and our leaders can pursue strategies that have a good chance of minimising the damage. This does however need clients, tier 1 contractors and the supply chain to recognise that they share an interest in keeping projects and programmes viable and to find intelligent and flexible ways to share the risks created by the current turbulence.

If that can be achieved we will be able to shield more workers from short term pain. It can also help avoid the permanent loss of thousands of people from the construction workforce that has been the consequence of previous recessions. This is vital. The industry simply can’t afford a further loss of capacity and capability on this scale. Over the next decade the sector and its clients face a series of huge and largely unpostponable tasks including delivering its contribution to decarbonising the economy, tackling a housing crisis and providing the infrastructure to drive flagging productivity. In these circumstances we simply must avoiding adding to construction’s already endemic recruitment, retention and skills development problems.

Construction is contracting; but from a high base

In 2021 and into early 2022, construction recovered well from the COVID 19 and overall output surpassed its pre-pandemic peak this Spring. This has led consultancy giant Arcadis to conclude in its UK Autumn 2022 Market View that, “with the slowdown starting from a highpoint, competitive pressure will take the edge off future price rises and this will be a shallow but prolonged dip rather than a blow out”.

So, it is important that we don’t panic and recognise we are entering a downturn on the back of the sector’s strong post COVID performance. In fact in some sub-sectors COVID is likely to have itself been a driver of growth with the race for space and the trend towards home working, fuelling demand for both new housebuilding and private repair & maintenance.

This growth has been achieved despite a backdrop of accelerating inflation. Taking one example year on year inflation of construction materials peaked in June this year at 26.4% (falling back to 17.8% in August). Price rises for some materials have been even more pronounced with aggregates up 62% according to the Office of National Statistics.

Inflation clearly isn’t going away and will now start to combine with some of the other drags on the sector – creating a dangerous moment. In a recent twitter thread, Noble Francis, Economics Director at the Construction Products Association explored the potential impact of inflation over the coming year. He suggests that “the key question will be, even if UK construction materials price inflation slows…, if it remains double-digit as construction demand falls … what will be the impact on the industry when UK construction has already lost 3,841 firms in the 12 months … its highest level since the financial crisis, (even) when demand has been strong”.

Construction output, insolvencies and materials costs 2020-22

Causes driving concern

Noble’s assumption of continued cost inflation seems well founded. The war in Ukraine and the recent decision by OPEC to reduce oil supplies suggest high energy costs are baked in for the foreseeable future. Wage inflation is also likely to be an issue with 71% of respondents to a recent Association for Consultancy and Engineering survey citing this as a major business concern.

On the demand side, house building, the single largest sub-sector of construction, was already slowing before the previous Chancellor’s mini-budget. This has led markets to price in higher-than-expected rises in interest rates, which in turn is driving up the cost of mortgages, slowing demand and causing a steep fall in the share price of the big housebuilders. Higher mortgage costs will also add to the squeeze in household incomes, cutting discretionary spending on private repair, maintenance and upgrade activity. Finally, the Building Safety Act received Royal Assent in April, and a new, post Grenfell safety regime for higher risk buildings will come into force over the next 18 months. This seems likely to push up costs for building residential towers, contributing further to the slowdown.

Inflation and uncertainty also seem likely to lead to more commercial property schemes, paused, rescheduled or cancelled altogether – even before the impact of the trend towards homeworking is taken into account. As a result investors are clearly re-thinking their strategies or even pulling out of the UK market completely.

On a more positive note, infrastructure (the second biggest sub-sector of UK construction) will hopefully benefit from ongoing mega projects such as Tideway and HS2 and the stability that comes from being financed via government or regulated utilities. Even here however there are reasons to be fearful. Budgets agreed at the last spending review are now worth less and the incoming Chancellor is looking to make big cuts to public spending. Local Authorities in particular are facing a heavy squeeze and even regulated businesses such as water companies may be tempted to push back projects into the next 5 year investment programme.

Avoiding a hard landing: What can be done?

One way of looking at current events is that the industry is returning to pre 2008 economic norms, leaving behind a decade of ultra-low interest rates in which policy makers have often worried more about deflation than rising prices. This must not lead to a return to some of the short-sighted, devil take the hindmost attitudes that too often characterised that era. When there is a shrinking amount of money in the system, clients or tier 1 contractors who try to push costs and risks down the supply chain do nothing to improve the long term viability of work programmes and will ultimately create a situation in which there is less work for everyone and more importantly worse outcomes for the public.

On this theme, Arcadis’ market update urges contractors to not panic and trigger “a race to the bottom in bidding and standards”. They also call on clients to “consider whether greater integration and collaboration can deliver more viable projects and deliver a better outcome”. Fundamentally clients, contractors and contractors need to recognise that over the medium to long term, demand remains high and they share an interest in maintaining the viability of projects and programmes. They should be willing to have sensible conversations about how to share the risk (and pain) that the current situation is generating and ensure that this is reflected in procurement and delivery strategies. Self-interested short termism on the other hand will prolong the pain of the downturn and store up yet more skills shortfalls in the decade ahead.

Share This Story, Choose Your Platform!

Related News

Get in touch

Please complete the form below and we will contact you as soon as possible.

To help us to respond to your inquiry as quickly as possible, we have put a handy list of our services below.